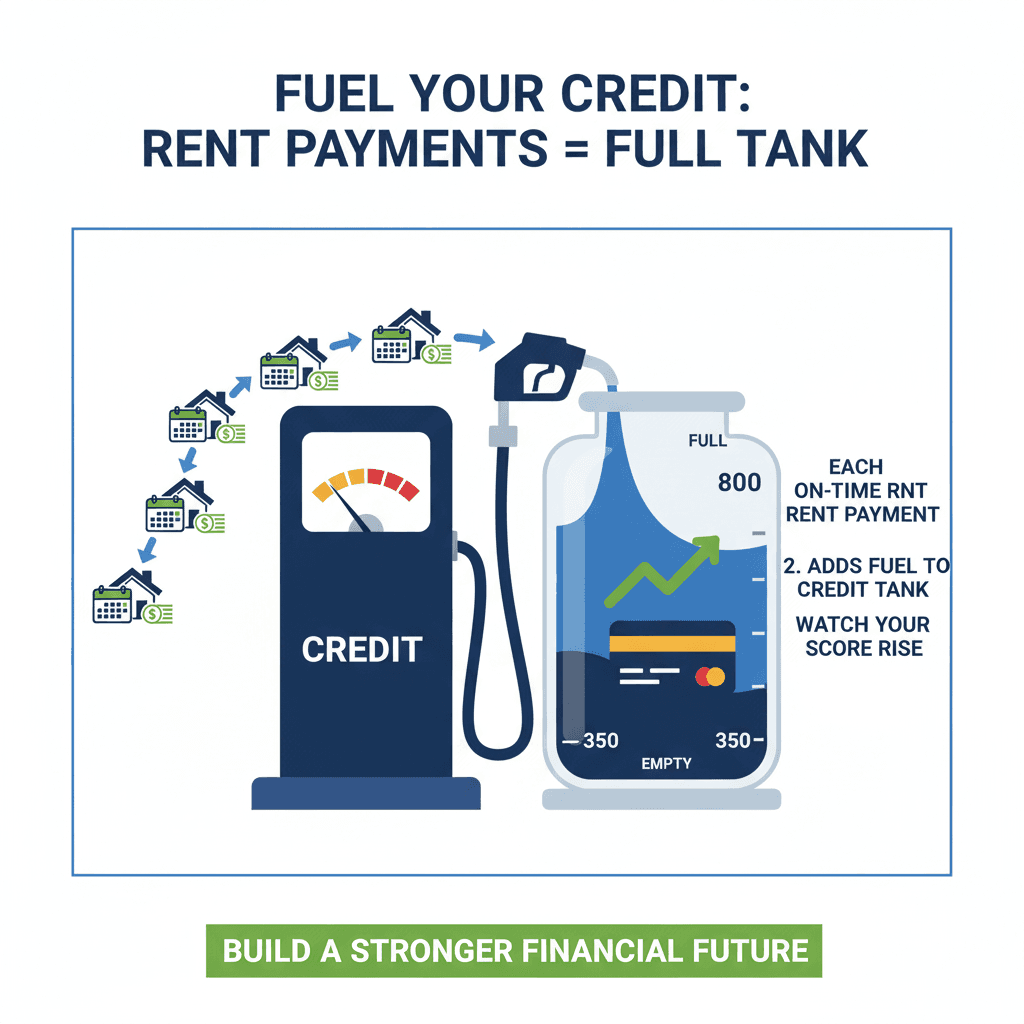

Your Rent is Building Your Credit Future

Don't miss out on turning everyday rent payments into credit score points

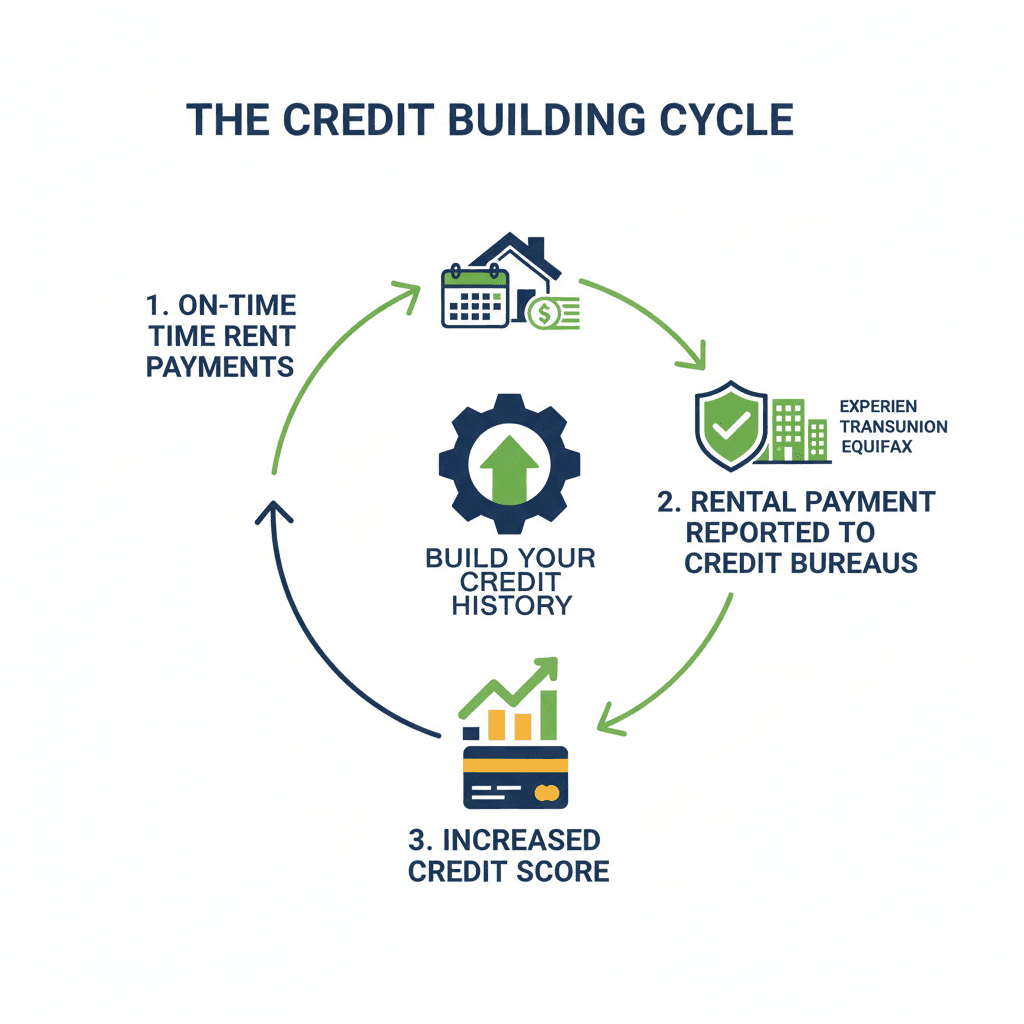

The smart way to build credit through rent. Every on-time payment adds positive history to your credit file.

Rent Reporting = Real Credit Reporting

Your rent payments flow through the same system as credit cards and loans, if you report it.

What Your Rent Could Be Worth

See how $1,500/month in rent transforms into valuable credit over time. Every on-time payment builds your financial future.

🔥 Don't break the streak! You're building the biggest slice of your credit score ~35%.

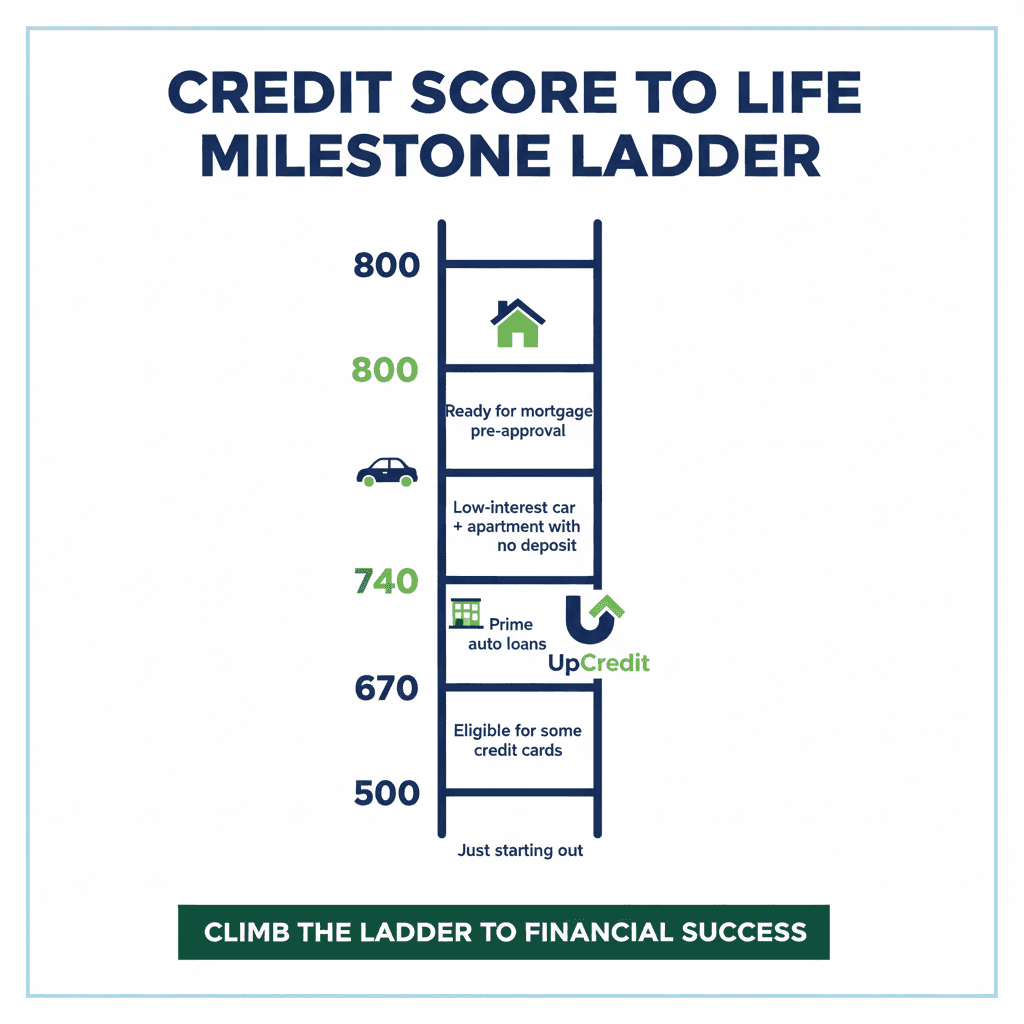

Why Credit Matters for Your First Car

Better credit means real money in your pocket. See how credit score directly impacts your auto loan rates and total costs.

- •Get approved without jumping through hoops. No co-signer conversations, no awkward explanations, no waiting.

- •Qualify for the "good stuff." Premium cards, better apartments, better cars, and better options in general are gated by credit.

- •Skip deposits and security holds. More money stays in your pocket instead of being locked up.

- •Unlock premium financial tools. Cards with travel perks, lounge access, concierge services, and meaningful rewards.

- •Say yes faster. Trips, moves, emergencies, and opportunities are easier when approval isn't the bottleneck.

- •Look low-risk on paper. Landlords, lenders, and insurers treat you like someone who has their life together.

- •Pay less for the same lifestyle. Same apartment, same car, same purchases—but with fewer penalties and better terms.

- •Future-proof yourself early. The earlier you build good credit, the more unfair the advantages feel later.

FICO Breakdown

What Makes Up Your Credit Score

Understanding how credit scores work shows why rent reporting is so powerful. You're already building the most important piece.

You're already building the biggest slice, don't stop now!

Myth vs Fact

Let's bust some common misconceptions about rent reporting and credit building.

Myth

Rent doesn't count for credit

Fact

Newer credit models include rent history, and it's reported to all major bureaus

Myth

Only credit cards matter for building credit

Fact

Payment history is 35% of your score, and rent is payment history

Myth

Opting out doesn't hurt

Fact

You'll stop adding positive history and miss out on building credit while you sleep

Don't Opt Out of Your Future

You're already enrolled and building credit. Every month you stay enrolled is another month of positive payment history on your credit file.